Steps To Purchasing A Home

- The Home Buying Process Step 1 – Speaking To A Mortgage Loan Originator

- The Home Buying Process Step 2 – The Mortgage Loan Application

- The Home Buying Process Step 3 — Pre – Qualification

- The Home Buying Process Step 5 – Contract Ratification

- The Home Buying Process Step 6 – Underwriting

- The Home Buying Process Step 7 – Settlement Date

Documentation needed for loan pre-approval:

+ 2 recent bank statements

+ 2 recent paystubs

+ Last 2 years W2’s and possibly tax returns

The “Home Ownership Wealth Escalator”.

Consider this example…

You have made the wise decision to purchase your first home.

You have found a home that meets your needs PLUS it is in a popular location allowing you to rent it out in the future.

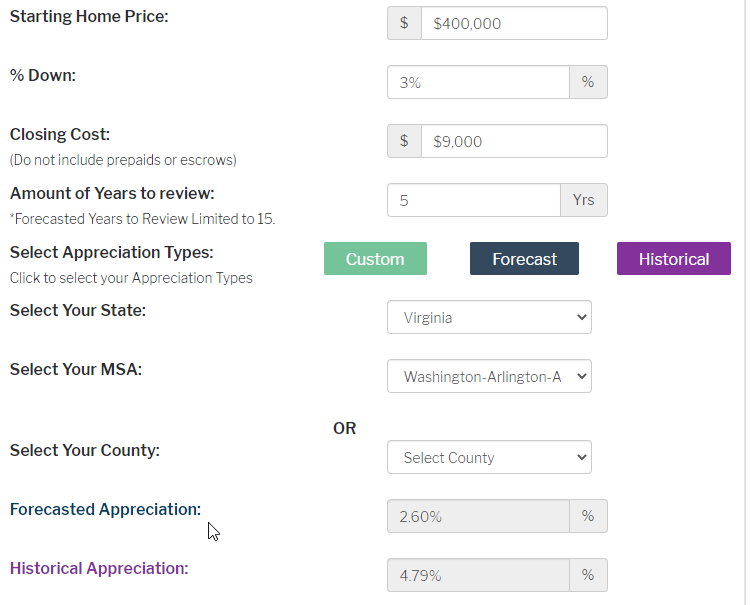

The sales price is is $400k and because this is your first time you only have to put 3% down.

The Home Buying Process And Appreciation

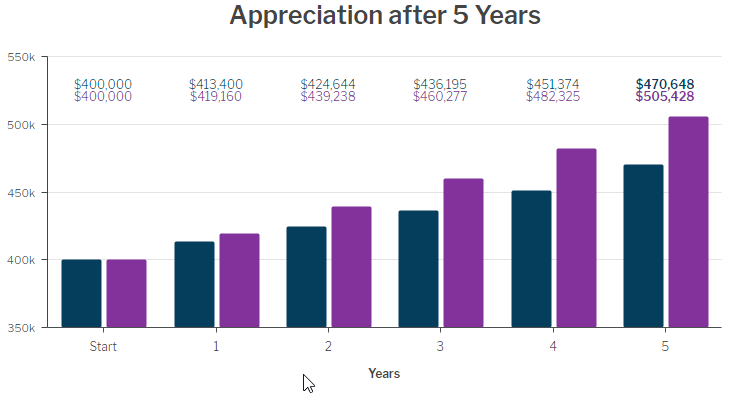

Let’s look at the illustration below.

As a first time home buyer, your minimum downpayment on a conventional loan is 3%

Let’s assume that you are purchasing a $400k home in the DC Metro area.

Closing costs can be around $9k and we will look 5 years out to see what you may earn as your property appreciates in value.

Looking out 5 years your property could be worth between $470,648 using forecasted appreciation or $505,428 if looking at the historical appreciation.

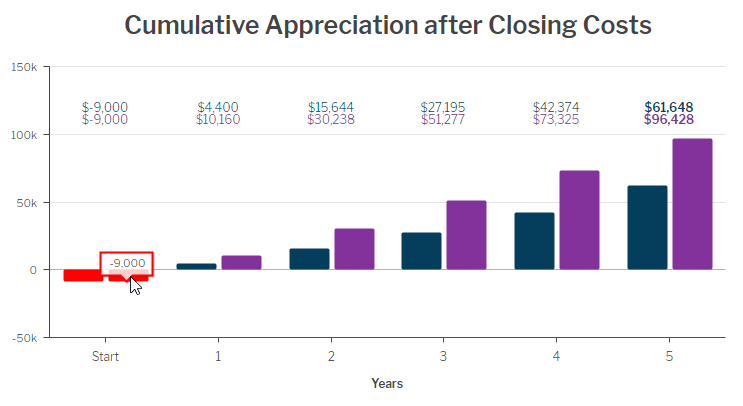

Could you earn $70,648 – $105,428 paying rent for 5 years?

Now let’s deduct the $9,000 you paid in closing costs and you have earned $61,648 – $96,428 in a 5 year period.

All you have to do is make your payments on time!

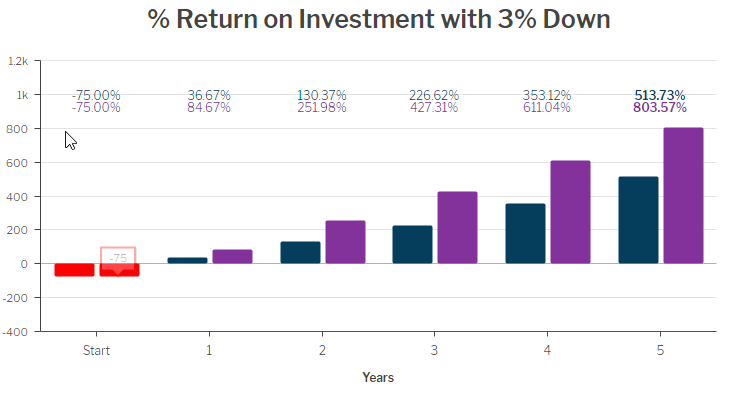

Your return on investment is staggering.

Where else are you able to grow wealth like this?

👉Want to see how much you may qualify for? 👈

Let’s get started with my hassle-free pre-qualification process today.

Have additional questions and want answers? CLICK HERE to find a time on my calendar that works for you.

=================================================================================

🔷Home Loans In Virginia And Maryland🔷

Rod Ferrier is a licensed loan originator in Virginia and Maryland.

A U.S. Navy Veteran, father of four, he began his career as a loan officer in 2002.

He specializes in assisting his clients to navigate the home buying process towards homeownership.

His clients include Veterans, first time home buyers, families looking to purchase a bigger home, as well as empty-nesters seeking to downsize.

Rod’s background in financial planning provides his clients with the opportunity to benefit from the wealth created by strategically purchasing the right home.

Trackbacks/Pingbacks