by Rod Ferrier | Jun 12, 2020 | Mortgage

You have arrived at Step # 7 of the home buying process – Closing Day. Your final step towards homeownership!

Remember the song “Closing Time” by Semisonic?

What about “End of The Road” by Boyz II Men?

What celebration song is on your playlist for your house warming party!

If you’re here, then you’ve found a home, negotiated the sale, and are ready to move in — and on. But before you can make this official (and get the keys!), you still have a few items to cross off your list.

Here is everything you need to know to have a successful settlement.

The Home Buying Process Step # 7 Settlement Date

Closing, or “settlement,” is when both parties (buyers/ Sellers) sign the final ownership and insurance paperwork.

This is the moment you have been dreaming of.

The moment when all of your hard work pays off…

Now you will become the legal owner of the home you picked out.

CONGRATULATIONS!

Related Articles

How To Buy A Home Explained

Typically, settlement takes place about 30-45 days after you signed the purchase and sale agreement.

During this time, your Earnest Money Deposit (EMD) is held in escrow until all contingencies, like the home inspection contingency and appraisal contingency, have been met.

Your agent will be able to answer questions and offer support through closing.

Buying A Home What To Expect At Settlement

Before You Close, You’ll Have a Final Walk-Through.

Most sales contracts give you one last chance to do a walk-through of the home within 24 hours of settlement.

This is your chance to check that the property is in good condition and to make sure any agreed-upon repairs have been completed.

In most cases, no problems arise at this stage of the transaction. (If something is amiss, your agent can walk you through it.)

The final walk-through mostly gives you peace of mind knowing that you and the seller, have adhered to the conditions of the sales contract and home inspection-related repairs.

Home Buying Process – Follow These Steps to Prepare for the Final Walk-Through

To help ensure that the walk-through goes smoothly, answer these 6 settlement questions to make sure you are prepared.

Question #1: Is the house clean?

Your new home should be spotless for the final walk-through. Assuming you are taking ownership on the day of closing.

The sellers should be fully moved out at this point. But moving can be messy.

After purging, packing, and moving, the sellers may want to do one more deep cleaning.

Make sure you have not been left a big mess!

Question #2: Do you have the owner’s manuals and warranties.

Make sure you have been given all manuals and warranties needed for home appliances.

Ask for physical copies and put these documents in one place with your settlement paperwork. If receipts from contractors for repairs are required, make sure to store them with the manuals.

Steps To Homeownership Revealed

Question #3: Are there preferred vendors?

Ask the seller about contact information for home contractors or maintenance companies that they’ve used in the past. These vendors are familiar with your home, and having a list of servicers you can trust will make it easy for you to take good care of your new home.

Question #4: Did sellers leave anything behind?

Do one more check throughout the home to make sure the seller is not leaving anything behind. One exception: You may want to ask for any unused or leftover paint cans in the colors currently in use within the home — but confirm with the seller first.

Question #5: Are the water valves off?

The last thing you want before closing is a flood. With your permission, the sellers have probably turned off your house’s main shutoff valve 24 hours before closing.

Question #6: Did you lock the door after your walkthrough?

Until settlement is complete, the seller is legally responsible for the home — meaning they’d be liable if there’s a break-in before closing.

So, the day before settlement make sure to close window coverings and lock the entry doors. If a house looks un-lived in, it’s a welcome sign to burglars. It’s a good idea to leave a porch light on or to set an interior light to turn on and off with a timer.

If the final walk-through reveals an issue with the house, don’t panic.

The standard protocol is for your agent to immediately alert the listing agent that there’s a problem. Then, both parties work together to solve it. Typically, either the closing gets delayed or there’s additional negotiation, such as monetary deduction of the sales price.

In other words: There are options, and your agent can help you through this.

Buying A Home: The “Closing Disclosure”

Let’s assume the final walk-through is smooth sailing. (Woo-hoo!) What happens next?

You’ll get info about your closing costs from your loan officer as well as the title company.

Meanwhile, your mortgage lender must provide you with a Closing Disclosure, or CD, three business days before settlement.

This is a formal statement of your final loan terms and closing costs.

The Home Buying Process – Expect to See These People at the Closing

Settlement typically takes place at the title company, attorney’s office, or the buyer’s or seller’s agent’s real estate office. (Unless you live in a state that allows for electronic closings — eClosings — with remote notaries. In that case, the involved parties can opt to sign documents digitally.)

The list of legally mandated attendees will depend on your state, but usually, you’ll be joined by:

- Your agent

- A title company representative

- The loan officer

- Any real estate attorneys involved with the transaction

Buying A Home – Remember to Budget for Closing Costs

Closing costs can vary widely by location, but you’ll generally pay closing costs of 3% – 4% of the home’s sales price.

So, on a $300,000 home, you can expect to pay anywhere from $9,000 to $12,000 in closing costs.

Closing costs for buyers typically include:

- Transfer taxes or recording fees

- Escrow accounts

- Homeowner association dues included up to the settlement date

- Prorated property taxes

- Escrow, title, or attorney fees

- Hazard insurance

- Lenders and/or owners title insurance

- Points to buy down the rate

- Appraisal fee

- Credit report fee

- Underwriting fee

- Processing fee

Buying Your First Home – What to Bring to Closing

At the closing you should have:

- A government-issued photo ID

- A copy of the ratified sales contract

- A cashier’s check, or proof of wire transfer, if your closing costs are not being deducted from the sales price.

(Yes, it’s OK to use a cashier’s check — especially if you don’t want to deal with the hassle of a wire transfer, which can take time to clear. With a cashier’s check, you’re guaranteed the money you need for settlement will be there at closing.)

=================================================================================

👉 Want to see how much you may qualify for? 👈

Let’s get started with my hassle-free pre-qualification process today.

Have additional questions and want answers? CLICK HERE to find a time on my calendar that works for you.

=================================================================================

🔷Home Loans In Virginia And Maryland🔷

Rod Ferrier is a licensed loan originator in Virginia and Maryland.

A U.S. Navy Veteran, father of four, he began his career as a loan officer in 2002.

He specializes in assisting his clients to navigate the home buying process towards homeownership.

His clients include Veterans, first time home buyers, families looking to purchase a bigger home, as well as empty-nesters seeking to downsize.

Rod’s background in financial planning provides his clients with the opportunity to benefit from the wealth created by strategically purchasing the right home.

by Rod Ferrier | Jun 11, 2020 | Mortgage

The Home Buying Process Step # 5 – The Purchase Contract. Buying a home is almost complete!

You are probably very excited at this point. Feeling anxious, nervous, little scared maybe…

Don’t worry, this is a normal feeling. Especially if you are a 1st time home buyer.

Home Buying Terms in The Real Estate Sales Contract

The real estate purchase agreement is a legally binding contract signed by home buyers and sellers that confirms a certain purchase price, closing date, and other terms including contingencies.

There are certain commonly used words you’ll want to remember as you continue down the road of homeownership.

These important words spell out RELATIVE INFORMATION such as how much money you’re paying, when you pay it, under what conditions you can back out of the purchase transaction, and more.

Below we will discuss 7 terms you are likely to come across in a real estate purchase agreement.

PLUS why you need to carefully check the provisions in the contract before you sign on the dotted line.

Related Articles

Home Buying Process And Escrow Accounts:

How does it feel to have finally found your new home?

What made you decide to purchase this specific house?

Was it a specific feature, amenity or community benefit?

Did you make the decision with an investment mindset?

Now that you have found your new home it is time to “Ratify” the purchase contract.

Your awesome real estate agent will have already sat down with you and walked through what a purchase contract looks like.

Residential Real Estate Purchase Contract

7 KEY-WORDS + 7 KEY-FACTS

HOME BUYING KEY- WORD #1- The Earnest Money Deposit (EMD)

The (EMD) as it is referred to, is the cash buyers commit to depositing towards the sale to show the sellers they’re serious about buying the home.

Checking the home’s purchase price on your contract is important as well, but you’ll need to be prepared to have money available to complete the sales contract.

The amount of the deposit is negotiable between both the selling and purchasing party.

EMD is typically 1% or maybe on a rare occasion 2% of the purchase price.

Once an offer has been accepted, the money is typically held by the seller’s broker or a title company, to be used as a credit toward the buyer’s down payment and closing costs.

NOTE: In an aggressive seller’s market, most homes receive multiple offers.

Be prepared for the competition!

If you find a home that checks off most of the boxes, don’t spend too much time thinking it over.

You will most likely lose out to more serious buyers. They have probably already lost out on multiple homes and understand the need to be prepared to act.

One way to make your bid stand out is to offer a slightly higher EMD (think 3% to 5%) to catch the seller’s attention.

This money simply goes towards downpayment and closing costs.

Any leftover funds are returned.

That being said, many buyers want to make the smallest deposit possible, to limit their risk of loss.

The caveat: If you back out of the transaction for any reason or contingency outlined in the purchase agreement, you get your earnest money back (more on contingencies next).

However, if you decide not to buy the house for any reason that is not included in the agreement, the seller can keep the earnest money.

HOME BUYING KEY-WORD #2 – Contingency

A contingency in a deal means there’s something the buyer (you) has to do for the process to go forward.

An example would be selling a property you already own.

Contingencies can also include a home appraisal, home inspection and mortgage loan approval.

NOTE: Contingencies protect you by giving you the ability to back out of the sale if something goes wrong.

They must be stated in the contract and in most cases allow you to receive your deposit back if you meet the conditions of the contingency.

Be aware that all contingencies have deadlines that must be met in order for the transaction to move forward.

HOME BUYING KEY-WORD #3 – Settlement Date

The settlement date, AKA “closing date,” is the day when all involved parties meet to make the sale official.

Buyers and sellers typically negotiate a settlement date that is mutually agreeable. In most cases, the seller determines which title company will be used to complete the sale.

Generally speaking, the buyers and sellers conduct their signing separately.

NOTE: When choosing a settlement date, make sure you’re giving yourself enough time to fulfill the home inspection, appraisal, and any other contingencies.

If you don’t meet your obligations to the purchase agreement by the settlement date, you could be considered “in default” and potentially lose your deposit.

HOME BUYING KEY-WORD # 4 – Possession Date

The possession date is the day when buyers can move into their new home.

Sometimes home buyers take possession of the home on the day of closing, and other times they agree to wait days or weeks after closing.

30 to 45 days is the most common time frame.

NOTE: The possession date is negotiable, and it can affect the strength of your offer.

For instance, if the seller needs a few extra months to find a new place to live, offering a 60-day possession date could make your bid more attractive.

Alternatively, some sellers allow the buyers to move in before settlement; this may occur if the house is already vacant.

HOME BUYING KEY-WORD #5 – Escrow

An Escrow Account is a secure holding area where important items (like the earnest money deposit check) are kept safe until the deal is closed and the house officially changes hands.

Although customs vary by state, the escrow holder is usually someone from the closing company, an attorney, or a title company agent.

NOTE: The purchase agreement states whether the buyer or seller (or both) pays escrow—with the fee for this service typically totaling about 1% to 2% of the cost of the home.

If you try to back out of the deal without a legitimate reason, you will forfeit your portion of the escrow money to the seller.

HOME BUYING KEY-WORD #6 – Delivery

When buyers and sellers sign a purchase agreement, they must agree to an accepted method of communication during the transaction as defined by the terms under “delivery”.

Email is generally an acceptable method of communication, but some people (say, older buyers or sellers) still prefer snail mail when receiving important documents, like the release of a home inspection contingency.

NOTE: Your buyer’s agent must abide by the terms of the delivery when communicating with the listing agent or seller. If documents aren’t delivered properly, it could delay or even void the contract.

HOME BUYING KEY-WORD #7 – Home Warranty

Simply put, a home warranty is a policy that covers the cost of repairing many of a home’s appliances if they break down. Basic coverage starts at about $300 and goes up to $600 for more comprehensive plans.

NOTE: Many home sellers will offer to pay for the first year of a buyer’s home warranty to entice buyers to bite, especially if the appliances in the house are old and/or it’s a buyer’s market. However, this must be written into the purchase agreement.

Next Step Towards Homeownership.

Step # 6 of the home buying process is underwriting. CLICK HERE to check it out.

Congratulations you are almost there!

=================================================================================

👉 Want to see how much you may qualify for? 👈

Let’s get started with my hassle-free pre-qualification process today.

Have additional questions and want answers? CLICK HERE to find a time on my calendar that works for you.

=================================================================================

🔷Home Loans In Virginia And Maryland🔷

Rod Ferrier is a licensed loan originator in Virginia and Maryland.

A U.S. Navy Veteran, father of four, he began his career as a loan officer in 2002.

He specializes in assisting his clients to navigate the home buying process towards homeownership.

His clients include Veterans, first time home buyers, families looking to purchase a bigger home, as well as empty-nesters seeking to downsize.

Rod’s background in financial planning provides his clients with the opportunity to benefit from the wealth created by strategically purchasing the right home.

by Rod Ferrier | Jun 6, 2020 | Mortgage

Step # 6 of the home buying process (Underwriting) could potentially be a big challenge for first time buyers as you navigate the road to homeownership.

During this critical step, a mortgage loan underwriter reviews the documents you have provided as you take the steps to own your home.

In Step # 1 of the home buying process, you spoke to a licensed loan originator to complete a rent versus buy analysis. You have determined that buying a home is a good fit for you and your family.

You moved ahead by taking Step # 2 of the home buying process and completing the loan application.

Moving on to Step # 3 of the home buying process you were pre-qualified by providing bank statements, pay stubs, tax returns and W2’s.

You know how much home you can qualify for and have moved to Step # 4 of the home buying process – the home search.

Now that you have completed Step # 5 to the home buying process you will give the ratified sales contract to your loan officer.

The Home Buying Process Step 6 – What To Expect In Underwriting

By this time you may have discovered that the road to homeownership can be windy and sometimes bumpy.

A good loan officer will have taken the time to carefully review your documentation, speak with his processor, and underwriter about potential concerns.

After doing his due diligence the bumps in the road will be visible to your loan officer and he/she will successfully guide you to the finish line.

Drama Free Path To Buying A Home

I do not like drama.

When I choose to work with a client one of the first things I share in our initial discussion is I am not like the T.V. station TNT…I don’t like drama.

My objective is to ensure that you have a smooth home buying process.

When your loan is in underwriting you can expect to be asked for more supporting documentation.

The underwriter’s job is to make sure you meet the guidelines for the loan program being used to buy your home.

Common loan types like Conventional, FHA, USDA, and USDA have standard guidelines that must be met by everyone seeking to qualify.

It is the underwriter’s duty to ensure that the borrower (you) meets the Ability To Repay (ATR) requirements stated in the relative loan program guidelines.

The underwriter will look at your Debt to Income Ration (DTI) to determine your ability to repay the loan.

Your DTI reflects how much of your income (before tax) is used to pay the debt.

This debt includes your new mortgage payment as well as any other debt listed on your credit report.

Car loans, credit cards, student loans…

These common loan programs have varying Debt To Income ratio requirements ranging from 38% – 56%.

Home Buying Process – Debt To Income Ratio

Here is an example…

Let’s assume as a W2 employee you make $5k a month.

Your monthly liabilities (debt) totals $500. Leaving you with $4500 month in qualifying income.

50% of your income is $2,250. This will fit in the FHA loan parameters.

FHA Loans allow borrowers to have DTI above 50%, a 3.5% minimum downpayment, and allows borrowers with less than perfect credit to qualify.

Note: Expect your total mortgage payment Principal Interest Taxes Insurance (P.I.T.I) to range between $2,000 monthly ($350k) and $2,250 ($400k).

It is possible that you may need a co-borrower to help make the DTI requirement.

The underwriter must verify all borrower’s qualifying information in this step of the home buying process….

Employment, assets in the bank or retirement accounts, credit history, tax returns, W2s, and identification.

Together these make up the foundation of the underwriting process.

The underwriter will often require more documentation from each of these categories listed above.

Once your home has been appraised the underwriter reviews the appraisal for any errors.

These could include a mistake in the value, address, county, and even room count.

Buying A Home – The Appraisal

The purpose of the appraisal is to ensure that the property being purchased is valued at or greater than the money being borrowed / lent.

Here is an example…

You are purchasing a home for $400k using an FHA loan which requires 3.5% down.

$400k x 3.5% ($14k).

An appraisal is done and the property is valued at $390k based on recent comparable home sales in that area.

What to expect next…

The property has appraised for $10k less than the sales price. There are two possibilities.

- You pay the difference

You are responsible for the difference in the event the sales price cannot be lowered.

$400k – 390k = $10k

Minimum downpayment ($14k) + ($10k) difference = $24k minimum downpayment.

2. Lower the sales price

The good news is that in most cases the seller will work with you to get the deal done.

Your agent will re-negotiate the sales price in an effort to lower the purchase price to match the appraised value.

Home Appraises For More Than Sales Price

What happens when the property is valued at more than the purchase price (assume $410k).

CONGRATULATIONS you have instant equity.

Equity is a critical part to accumulating wealth through real estate.

As you continue to make payments your loan balance goes down.

Over time your property appreciates in value due to demand for housing.

The combined forces or principal reduction and appreciation is your ticket to lasting wealth with real estate.

First Time Buyer Loan Programs In Virginia And Maryland

If you are purchasing your first home it is a good idea to explore the benefits of putting as little money down as possible.

Your first time buyer status opens up doors to programs specifically designed to help you purchase your first home.

These benefits minimize the money you need available by providing grant money to cover a portion of your down payment.

In Virginia, I utilize the VHDA LOAN Program. This amazing program gives my first time buyer’s up to 2% towards downpayment for conventional loans.

First time buyers using the grant money for an FHA loan will receive 2.5% of the 3.5%

The biggest overall benefit to consider when lowering the amount towards downpayment as a first time home buyer is you will have more money in savings in the event life happens. Because it does and it will.

There are times when it is helpful to have a larger downpayment.

+ purchasing 2nd home requires 5% downpayment versus 3 as first time buyer.

+ Eliminating mortgage insurance requires 20% or more downpayment.

These are just 3 of the most popular reasons to put more than 3% down.

The Home Buying Process – Clear To Close

By this point, you have had a title search, home inspection, survey, pest treatment, and radon inspection.

These documents will be provided to the underwriter for review as well.

Start to finish, most lenders can underwrite a file in 7-14 days depending on volume.

During this 2 week period, you need to be prepared to be very responsive to your loan officer and his/her team members.

They are in place to support you and make sure you close the transaction by the date in your contract.

Once all conditions have been met your file will be marked Clear To Close.

These are 3 words that will have significant meaning to you once you have complete the underwriting step of the home buying process.

Final Step Towards Homeownership.

Step # 7 of the home buying process is closing day. CLICK HERE to jump to the last step.

Congratulations you are almost there!

=================================================================================

👉Want to see how much you may qualify for? 👈

Let’s get started with my hassle-free pre-qualification process today.

Have additional questions and want answers? CLICK HERE to find a time on my calendar that works for you.

=================================================================================

🔷Home Loans In Virginia And Maryland🔷

Rod Ferrier is a licensed loan originator in Virginia and Maryland.

A U.S. Navy Veteran, father of four, he began his career as a loan officer in 2002.

He specializes in assisting his clients to navigate the home buying process towards homeownership.

His clients include Veterans, first time home buyers, families looking to purchase a bigger home, as well as empty-nesters seeking to downsize.

Rod’s background in financial planning provides his clients with the opportunity to benefit from the wealth created by strategically purchasing the right home.

by Rod Ferrier | Jun 3, 2020 | Mortgage

Want to know the most exciting part of the journey to homeownership? Follow me as we discuss Step # 4 of the Home Buying Process – The Home Search.

Congratulations you have made it past the halfway mark to buying a home.

Steps To Purchasing A Home

Documentation needed for loan pre-approval:

+ 2 recent bank statements

+ 2 recent paystubs

+ Last 2 years W2’s and possibly tax returns

+ Copy of your drivers license

CLICK PLAY

The Home Buying Process – Finding The Right Property

What is important to you as you consider purchasing a home?

Is it the number of bedrooms?

Maybe it is the size, look, and feel of a kitchen?

The back yard?

How about the neighborhood, schools, location…?

Here in Step # 4 of the home buying process, you will enjoy spending time with your real estate agent looking for properties that meet the needs of you and your family.

By making it this far you have an idea of how much you could qualify for, an estimated monthly payment, as well as an idea of how much money you will need to complete the transaction.

Now you are ready to complete this step by teaming up with your realtor.

Common First Time Home Buyer Mistake:

Imagine you are at an airport preparing to leave for a 2 week vacation.

You have two 45 pound suitcases and have to catch a flight in less than 10 minutes.

Rushing through the terminal you approach the longest flight of stairs you have ever seen.

Your flight departs from the second level in T-minus 7 minutes…

Beside this never-ending flight of stairs is an escalator.

Your options are to climb the stairs with ninety pounds of extra luggage or simply allow the escalator to do the hard work for you.

Which do you choose?

If you picked an escalator this information is for you.

If you picked the stairs, keep climbing. You have missed your flight but may catch the next one.

The “Home Ownership Wealth Escalator”.

Are you a first time home buyer?

If this is your first time purchasing a home or even your 2nd or 3rd time allow me to introduce you to a little known wealth strategy.

Viewing the property as a place to live as you walk through step # 4 of the home buying process may ultimately cost you thousands of dollars.

Where do you want to be financially in 2 years, 5 years, 10 years or even into retirement?

Are you interested in a strategy that will have other people making your mortgage payment for you during retirement?

This same strategy is practiced by almost every successful investor on the planet.

Is building generational wealth that you can share with your children, grandchildren, or even great-grandchildren something you would consider?

A common mistake most first time and even repeat home buyers make is viewing the house as a place to live rather than an investment into theirs and their families future.

This will allow you to make an educated decision as to which property will provide you the best return on your investment (ROI).

Consider this example…

You have made the wise decision to purchase your first home.

You have found a home that meets your needs PLUS it is in a popular location allowing you to rent it out in the future.

The sales price is is $400k and because this is your first time you only have to put 3% down.

The Home Buying Process And Appreciation

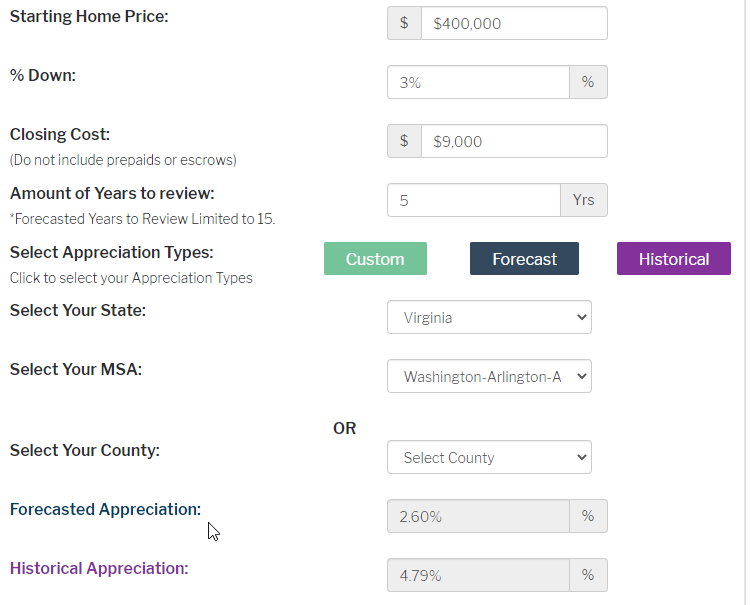

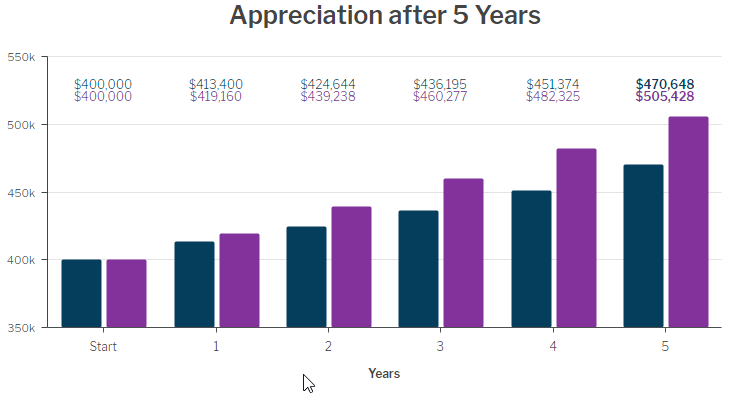

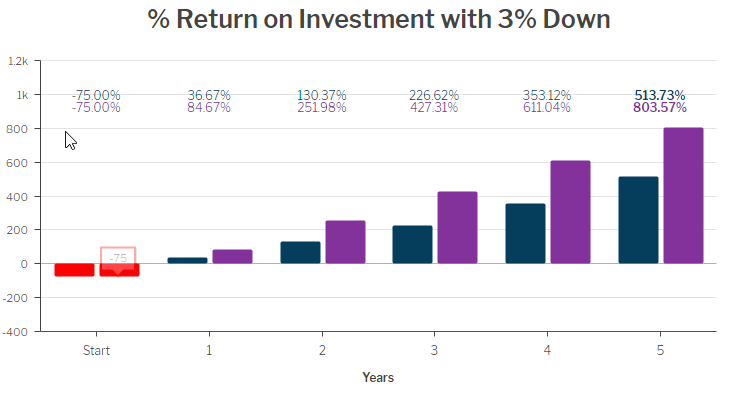

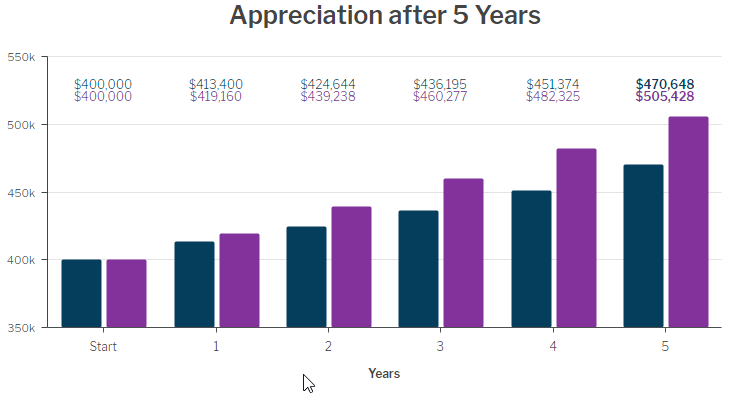

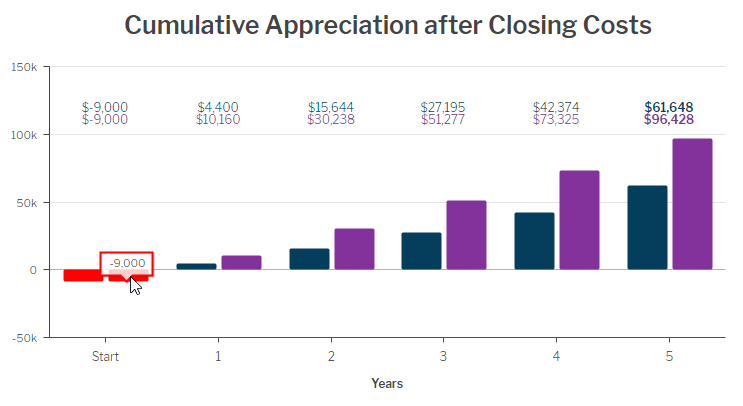

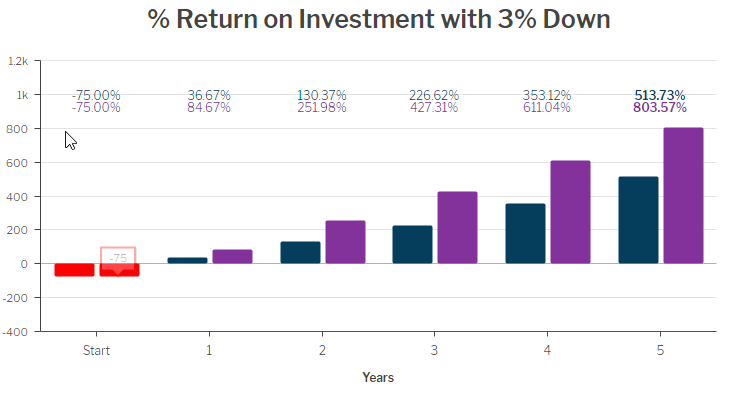

Let’s look at the illustration below.

As a first time home buyer, your minimum downpayment on a conventional loan is 3%

Let’s assume that you are purchasing a $400k home in the DC Metro area.

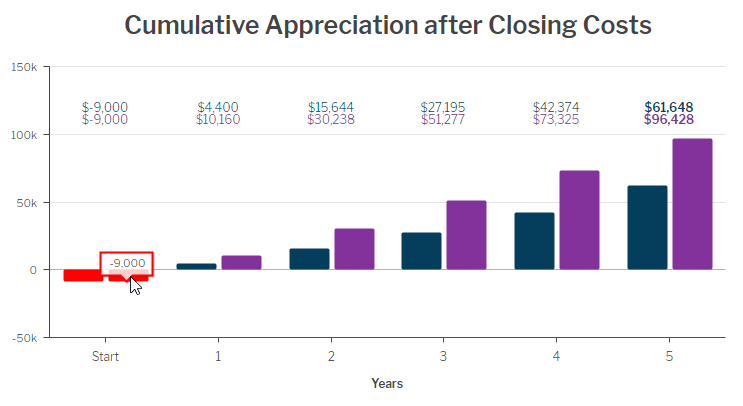

Closing costs can be around $9k and we will look 5 years out to see what you may earn as your property appreciates in value.

Looking out 5 years your property could be worth between $470,648 using forecasted appreciation or $505,428 if looking at the historical appreciation.

Could you earn $70,648 – $105,428 paying rent for 5 years?

Now let’s deduct the $9,000 you paid in closing costs and you have earned $61,648 – $96,428 in a 5 year period.

All you have to do is make your payments on time!

Your return on investment is staggering.

Where else are you able to grow wealth like this?

👉Want to see how much you may qualify for? 👈

Let’s get started with my hassle-free pre-qualification process today.

Have additional questions and want answers? CLICK HERE to find a time on my calendar that works for you.

=================================================================================

🔷Home Loans In Virginia And Maryland🔷

Rod Ferrier is a licensed loan originator in Virginia and Maryland.

A U.S. Navy Veteran, father of four, he began his career as a loan officer in 2002.

He specializes in assisting his clients to navigate the home buying process towards homeownership.

His clients include Veterans, first time home buyers, families looking to purchase a bigger home, as well as empty-nesters seeking to downsize.

Rod’s background in financial planning provides his clients with the opportunity to benefit from the wealth created by strategically purchasing the right home.

by Rod Ferrier | May 28, 2020 | Mortgage

You are on your way to homeownership! Step # 3 of the home buying process is Pre-Qualification.

During this step, you will be providing the documents we discussed in Step # 2 – The Mortgage Loan application.

+ 2 recent paystubs

+ 2 recent bank statements for accounts being used in the transaction

+ 2 recent years tax returns and W2’s

+ Copy of drivers license (front and back)

Prefer keeping things simple and easy?

Especially big decisions like purchasing a home?

If you answered yes then you’ll love the “Hassle-Free” home buying process I have developed.

Home Buying Process – The Path To Homeownership

I utilize state of the art technology that allows you to complete the mortgage loan application using your mobile phone or a PC.

This amazing system allows you to upload the necessary documents directly to an encrypted loan portal, saving you valuable time.

Using your cell phones built-in camera as a scanner eliminates the need for a scanner or copier.

Once these items are received I will calculate your monthly income and update your assets as needed.

The next step in the pre-qualification process is comparing the data entered with the guidelines of the loan programs you may qualify for.

Mortgage Loan Programs In Virginia and Maryland

Here are a few programs that we can utilize

Conventional Loan – minimum down-payment for first time home buyers is 3%, all others 5%

FHA Loan – minimum down-payment 3.5%

Maryland Mortgage Program (MMP) – Down payment assistance available for qualified first time home buyers

USDA Loan – 100% financing for qualified areas

VA Loan – 100% Financing for active duty and veteran military

Virginia Housing Development Authority (VHDA) – Down payment assistance available for qualified first time home buyers.

These are the main mortgage programs used and there may be others available for different buying scenarios.

Feel free to reach out if you have a specific need or question regarding loan programs.

Once we have determined the loan program that best fits your needs you are ready for step # 4 of the home buying process – The home search.

Are you excited?

Now you have an idea of how much home you are able to purchase, your estimated monthly payment, and an idea of how much money you will need to complete the transaction.

Want to see how much you may qualify for?

Let’s get started with my hassle-free pre-qualification process today.

Have additional questions and want answers?

CLICK HERE to find a time on my calendar that works for you

Home Loans In Virginia And Maryland

Rod Ferrier is a licensed loan originator in Virginia and Maryland.

A U.S. Navy Veteran, father of four, he began his career as a loan officer in 2002.

He specializes in assisting his clients to navigate the home buying process towards homeownership.

His clients include Veterans, first time home buyers, families looking to purchase a bigger home, as well as empty-nesters seeking to downsize.

Rod’s background in financial planning provides his clients with the opportunity to benefit from the wealth created by strategically purchasing the right home.

by Rod Ferrier | May 25, 2020 | Mortgage

Congratulations – Homeownership is getting closer! You have made it to step # 2 of the home buying process the Mortgage Loan Application.

You have already completed step # 1 of the home buying process, talking to a licensed loan originator.

If this is you are a first time home buyer, your loan officer has already sat down with you and shared a rent versus buy analysis.

You have now made a wise decision to take the next step towards home ownership and building wealth.

You are probably feeling excited, nervous, and have lots of questions.

Don’t worry this is normal.

I have worked with dozens and dozens of first time home buyers over the past 18 years and assure you that the jitters you are feeling are common.

During the loan application process you will discover what you can expect in terms of a mortgage interest rate, payment, and approximately how much home you are qualified to purchase.

Home Buying Process Step # 2 –

Completing The Mortgage Loan Application

This begins with completing the loan application.

It takes less than 10 minutes to complete and you will start off filling in your personal information.

Name, address, date of birth, and social security number.

You will need to provide a complete 2-year living history as well as a 2-year work history.

It helps if you provide the company name, address, phone number, and dates of employment.

Next is to provide your monthly income as well as how much money you have in the bank.

NOTE: For mortgage loan purposes we need your income before taxes.

You can calculate this yourself or you can estimate your income and provide your loan officer a copy of your pay stubs.

To calculate your income as an hourly employee you simply multiply your hourly wage by the number of hours worked in a week.

Then you multiply that by 52 (number of weeks in a year) and divide by 12.

So assume you make $20 per hour and work 40 hours a week.

20 x 40 x 52 divided by 12 = $3,466.67 monthly income.

If you receive a salary you simply divide your annual salary by 12.

NOTE: If you receive a bonus, commission, or overtime you will need to have a 2-year history of doing so in order to use this income for qualifying.

As lenders we take a 2 year average of this type of income.

Work two jobs?

You will also need a 2-year history of working 2 jobs.

Self-employed buyers will need to provide 2 years of tax returns (all pages and schedules) and possibly a year to date profit and loss statement.

Items needed for mortgage loan application

A good loan officer will go beyond just checking credit.

Having good credit is important but this is only 1 piece of the loan process puzzle.

A good loan officer will make sure to calculate income and verify money to close in an effort to ensure you have a smooth home buying process.

Have credit issues? Don’t worry, I can help with that as well. CLICK HERE for more info.

To save time and simplify the process make sure to have the following documents ready for your loan officer:

+ 2 recent paystubs

+ 2 recent bank statements for accounts being used in the transaction

+ 2 recent years tax returns and W2’s

+ Copy of drivers license (front and back)

You will finish out the loan application by answering a few questions.

Have you filed for bankruptcy?

Have you ever filed for a foreclosure?

Are you delinquent on any federal debt?

Do you have any judgments or liens against you?

Are you a U.S. citizen or Permanent Resident Alien?

Have you had ownership in a home in the last 3 years?

Next step is to review the information provided and submit the loan application.

I utilize a platform that allows my clients to complete the application on their mobile phone or on a computer or tablet.

This platform also allows you to upload the documents listed above into an encrypted loan portal to save you time.

CLICK HERE to apply and see for yourself.

Avoid these common mistakes people make when purchasing a home.

DO NOT apply for new credit until after the home purchase is complete.

DO NOT make any large deposits or withdrawals without first consulting with your loan officer.

DO NOT pay down credit card balances without first consulting with your loan officer.

DO NOT quit or change employers without first consulting with your loan officer.

DO NOT miss any payments or have a late payment.

Have additional questions and want answers?

CLICK HERE to find a time on my calendar that works for you

Homeownership In Virginia Or Maryland

Rod Ferrier is a licensed loan originator in Virginia and Maryland. NMLS# 203976

He is a U.S. Navy Veteran, father of four, and began his career as a loan officer in 2002.

He specializes in assisting his clients to navigate the winding road of homeownership. His clients include Veterans, first time home buyers, families looking to purchase a bigger home, as well as empty-nesters seeking to downsize.

His background in financial planning provides his clients with the opportunity to benefit from the wealth created by strategically purchasing the right home.

Recent Comments